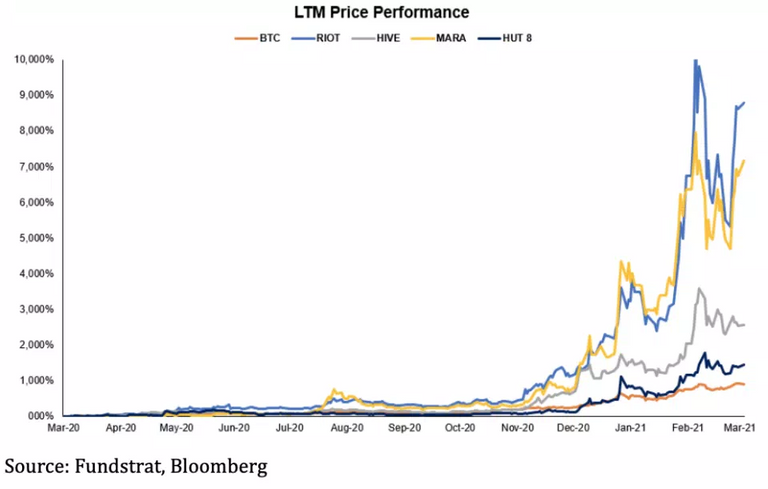

Crypto Mining Stocks Hotter than BTC?

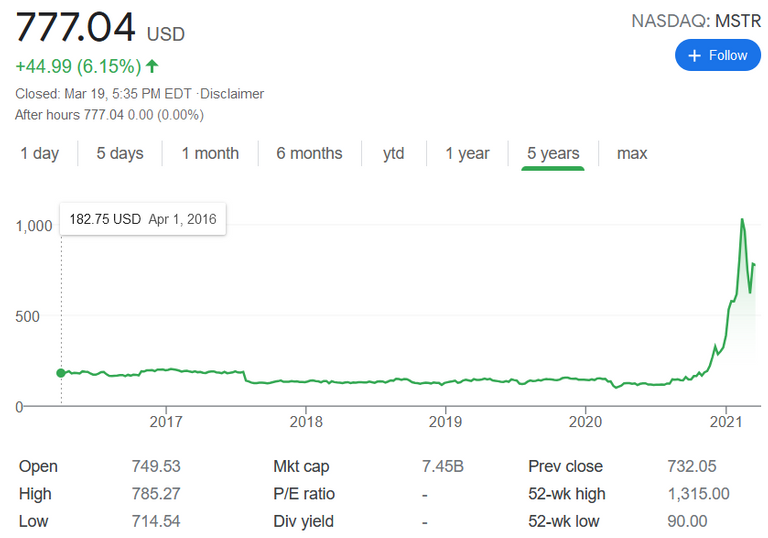

In the beginning of the Covid crisis in 2020 the boom in crypto has been much more intense in stock tickers than the crypto themselves. This is still the case today. Look at MSTR for instance.

Although MSTR is just a holder of btc it is clear the demand for investing in crypto related stocks are red hot. Funstrat commented:

Because “miners play such a critical role in ensuring the Bitcoin network functions properly, investors have sought opportunities to gain exposure to mining companies,” which generate revenue in the form of mined bitcoin.

There is a lot that make sense that miners will play a big role in the price of crypto. A lot of the top crypto coins such as BTC and ETH operate under proof of work which requires miners to operate in order for the crypto to operate whether in transfer or in production.

Funstrat also warns of the risk in investing in mining stocks as the appreciation is going exponential.

But buyer beware: “Mining company equities may serve as a high-beta play on bitcoin … [and when the cryptocurrency] enters a bear cycle, we would expect mining equities to have greater downside volatility than bitcoin,” according to FundStrat.

The hype for crypto is high right now but if it slows down or drops the miner stocks will likely suffer the most because of their high beta play.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Posted Using LeoFinance Beta

!wine

Congratulations, @logicforce You Successfully Shared 0.200 WINE With @mawit07.

You Earned 0.200 WINE As Curation Reward.

You Utilized 2/3 Successful Calls.

Total Purchase : 24480.932 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.300 HIVE

Thanks !wine

Congratulations, @mawit07 You Successfully Shared 0.200 WINE With @logicforce.

You Earned 0.200 WINE As Curation Reward.

You Utilized 2/3 Successful Calls.

Total Purchase : 24480.932 WINE & Last Price : 0.290 HIVE

HURRY UP & GET YOUR SPOT IN WINE INITIAL TOKEN OFFERING -ITO-

WINE Current Market Price : 0.300 HIVE

https://twitter.com/mawit07/status/1373497833752555520

Yay! 🤗

Your post has been boosted with Ecency Points.

Continue earning Points just by using https://ecency.com, every action is rewarded (being online, posting, commenting, reblog, vote and more).

Support Ecency, check our proposal:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal