Unsustainable Housing

Affordability Under Scrutiny: Unraveling the Data

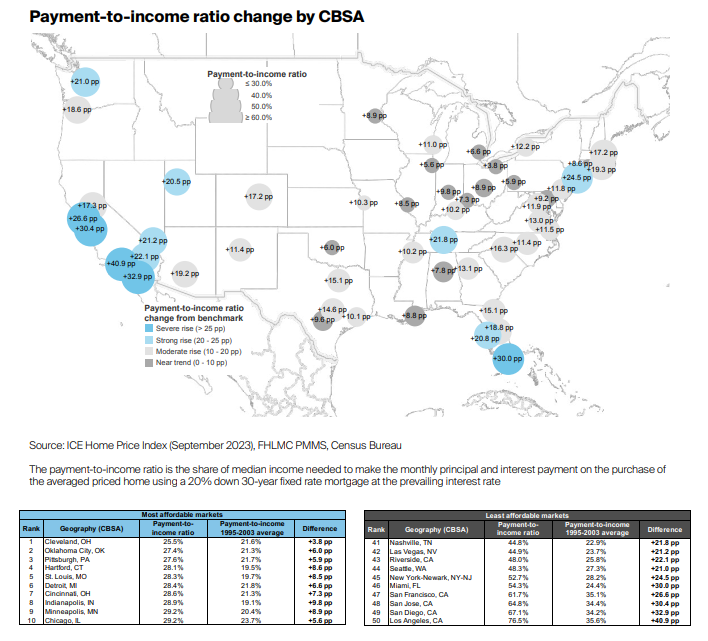

As I delved into the data, a stark reality emerged—the United States housing market is grappling with the strains of unsustainability from an affordability perspective. The soaring prices and the growing gap between income and housing costs have set the stage for a complex narrative with potential repercussions for homeowners and investors alike.

Investment Dynamics: Navigating Peaks and Valleys

As someone deeply entrenched in real estate, I've often pondered the implications of the inevitable normalization of the housing market. The ebb and flow of property values are not just financial indicators; they become integral parts of our investment decisions, influencing the trajectory of our financial journeys.

Riding the Waves: Lessons from Volatility

In my journey through real estate, I've experienced the undulating waves of housing market volatility. The decision to purchase my latest home near the peak raises questions about risk and resilience. While I may be at the mercy of market fluctuations, there's a certain tenacity in weathering the storms, driven by the belief in the long-term potential of homeownership.

Investing in Home and Heart: A Long-Term Perspective

Despite the uncertainties and the data pointing towards unsustainable affordability, my commitment to investing in my home remains unwavering. There's a sentiment that transcends market dynamics—a belief that a home is not just a financial asset but a sanctuary where life unfolds.

The Road Ahead: Balancing Risk and Reward

As the housing market faces the prospect of normalization, navigating the road ahead involves a delicate balance between risk and reward. The decisions made in the face of shifting market dynamics will shape not only financial outcomes but the very essence of home and hearth.

In the labyrinth of the United States housing market, where affordability strains reach unprecedented levels, the journey becomes a delicate dance between financial prudence and the enduring belief in the value of home. As I navigate the peaks and valleys, the decisions made today will echo in the corridors of investment dynamics and homeownership resilience.

Discord: @newageinv

Chat with me on Telegram: @NewAgeInv

Follow me on Twitter: @NAICrypto

The following are Affiliate or Referral links to communities and services that I am a part of and use often. Signing up through them would reward me for my effort in attracting users to them:

Start your collection of Splinterlands today at my referral link

Expand your blogging and engagement and earn in more cryptocurrencies with Publish0x! Sign up here!

My go to exchange is Coinbase; get bonuses for signing up!

The future of the internet is here with Unstoppable Domains! Sign up for your own crypto domain and see mine in construction at newageinv.crypto!

Always open to donations!

ETH: newageinv.eth

BTC/LTC/MATIC: newageinv.crypto

Disclosure: Please note that for the creation of these blog posts, I have utilized the assistance of ChatGPT, an AI language model developed by OpenAI. While I provide the initial idea and concept, the draft generated by ChatGPT serves as a foundation that I then refine to match my writing style and ensure that the content reflects my own opinions and perspectives. The use of ChatGPT has been instrumental in streamlining the content creation process, while maintaining the authenticity and originality of my voice.

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.