Walmart CEO Issues Dire Warning "Prepare For Deflation"

The banksters worst fear is deflation. With fractional reserve lending, deflation means currency destruction.

And since there is always less currency than debt, running out of currency is a real problem. The bank can run out of money, while their books say they are still solvent.

To give an example, having a fractional reserve limit of 10% means for ever dollar that exists, there are $10 worth of loans. So, if something happens to cause $1 of deflation, there is now, no dollars, and $9 worth of loans. And they whole system falls apart.

Of course, inflation is the name of the game, $1 of inflation means the banksters get $1 and they can leverage that into $10 more of loans. Win, win, win for the fractional reserve lender.

But, going the other way (deflation) quickly means the system runs out of money (liquidity crisis)

What really is a liquidity crisis?

Can you imagine a time when everything is on sale, but no one can buy anything, because there is no money.

(This actually, literally happened to some towns during the great depression. There was literally no money to buy anything. Many places created wooden nickels to have something to exchange goods with.)

Right now, house prices are really, really high. But, that is only because, currently, supply is limited. If twice as many people decide to sell their houses, then market starts to drop. If 5x the people decide to sell, the market plummets.

A liquidity crisis is where a bank has assets on the books, but they cannot sell them without incurring a loss, and this loss compounds the more they have to sell. The more they sell, the lower the sales price goes.

So, these banks cannot get the dollars they need to continue day to day transactions.

And so, the banks start doing evil things like saying you cannot withdraw large amounts of money. You need to apply in writing, days in advance, to get the cash, and we may deny the withdrawal. They encourage people to use digital payment which doesn't actually use any cash, the liquidity that is needed to stay in business.

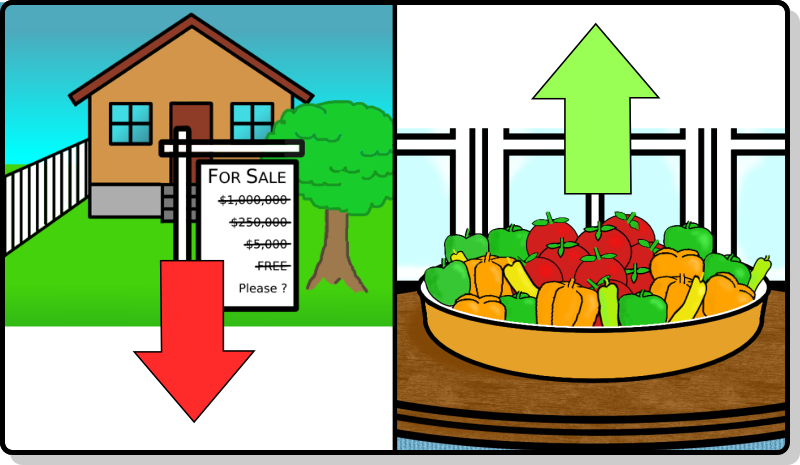

Deflation is coming, what does it mean?

It means asset prices are going to start dropping.

When there isn't enough cash in the system, a seller has to drop their price, and drop their price, and drop their price.

Imagine that there were no more mortgages. (banks just stopped doing mortgages) What happens to the house prices? Well, the first houses with really dropped prices might get scooped up by flippers and other people who have cash for buying houses. But, soon after, the price keeps dropping. The normal person doesn't have much actual money to pay for a house.

We used to demand 20% down when buying a house. So people would save up ⅕th of a house in order to get a mortgage to buy the house. Today it is under 3%. People are having a tough time coming up with 3% down for a house. And these are the people who are really trying to afford a house.

So, the housing prices will quickly devolve to less than 20% of today's value. And maybe down to 3%. There is a point at which it is just not worth the effort to sell the house.

Thus, deflation means that everything will be on sale, and most people won't have money to buy anything.

Food prices will still rise

Although commodity prices will also drop, the consumer prices of needed good will rise. I wish this was just greedy mother WEFers controlling things, but it is more about people cutting back, and less money flowing through the system, and businesses have fixed overhead costs, so the reduced amount they sell has to cover that. So, everywhere along the line, necessary goods prices rise.

This doesn't even take into account poor food harvests. Soon there won't be enough wheat for the world, and so prices will rise.

On top of this, more wars will break out. People being squeezed from both sides often make tempers hot. War always makes food more expensive. Even if it is just because ships have to sale around the conflict.

Expect all the necessities prices to keep rising.

If things were normal, the correct course of action is to sell everything you can now, while there are still people with money, sit on the money until everything goes on sale, and then buy what you want at the reduced prices.

However, there are many things that are different this time.

We have the corporation Black Rock who seems to be setting itself up to do the same thing. Buy up houses at reduced prices. So, there will be competition for buying.

And, there is no safe place to store money. If you leave the money in the bank, you may lose it as the banks close and bail-in. If you park it in bonds or stocks, you may not be able to sell those. Deflation will affect those too. Cash will probably be king during this period, but getting any goodly amount of cash out of banks today is very difficult.

It may be that trades for crypto will be the thing. As asset prices drop, it will be the crypto bull run. And the people selling cars and houses for bitcoin will skyrocket (there are already people on Craigs list selling for crypto).

I strongly suggest growing a garden. Work out how to get food through other means than the grocery store. Things are about to change greatly. (about meaning 1 month to 3 years, your mileage will vary)

Congratulations @builderofcastles! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 45000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: