Most of the Wealth People Think They Have Is Their Home, Especially Baby Boomers

All the people, who aren't just cheerleaders, are saying we are at the top of the next housing crash.

And it is really apparent. We have the Fed who has more than doubled interest rates (which means house prices have to lower A LOT to be as affordable). People are being laid off, and the jobs that are available are not as well paying, so there are less people who can afford very high mortgages. And the demographics collapse…

The only thing that has kept house prices from falling off a cliff is that supply has been extremely low in many areas. And that is coming to an end.

Homebuilders are abandoning housing developments, or building them to rent.

Things are not good, and are about to get lots worse.

Especially for the Baby Boomers.

Boomers trying to cash out

About 1 in 4 people in The US are boomers. And they are retiring, or soon, will be forced to retire, soon.

Many of them have little money saved for retirement.

Some of them, their only net worth is their house.

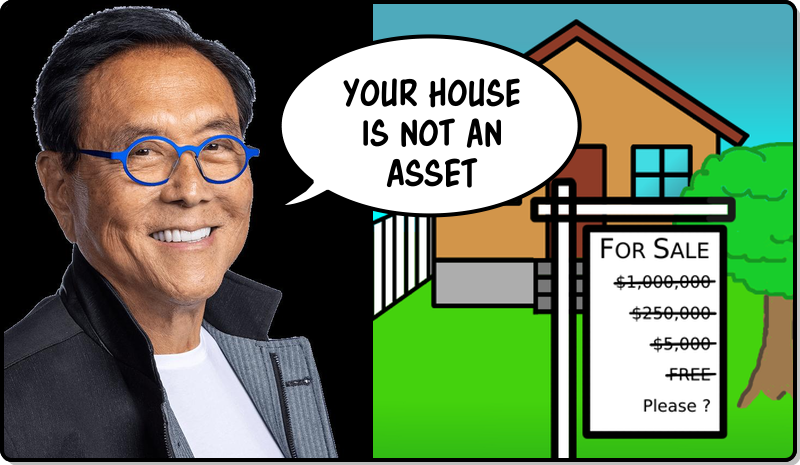

What a horrible lie we told, that "your house is your biggest investment", when in fact it is your biggest liability. Only through manipulation has the price been continually going up.

The big problem for these boomers is they plan on tapping their home's equity to fund their retirement. But, by the time they do that, there will not be any equity to tap. Their might not even be mortgages.

If nothing else happens to the housing market, boomers selling their houses to move to warmer climates, a smaller house, to move into a retirement community… will cause the housing market to collapse. The mere act of trying to turn their house into an asset will make it not an asset. Imagine, 1 in 4 houses on your suburban street have for sale signs on them.

I fear that the boomers will learn, to late, what Robert Kiyosaki has been saying for half a century, "Your house is not your biggest asset, Your house is your biggest liability"

Boomers Move to Cemetery Plots

Soon (as decades are concerned) after the boomer start selling in mass and driving the housing prices into the ground, then the boomers will be shuffling off their mortal coils.

We do not have the birth rate to keep up with death rate. We are way below replacement. We have built more suburban houses than we will ever need.

We will see 1 in 4 houses being left empty. Imagine being in the market to buy a home, and on any given street, bunches of houses are for sale, and are currently sitting empty. Some may call this a buyers market. But really, there won't be any market. What is the value of something that is strewn about just laying unused? In fact, we pay people to pick that stuff up and put it in the rubbish bin.

There will be so many empty houses, and so little money to demand proper transfer of titles, that anyone who wants a house will just move in to an empty place.

Except for the illegal immigrants coming in to bolster numbers, we would already see this happening.

This is demographics. It is coming, even if nothing else happens to make it even worse.

The suburban real estate market is even worse than that

If you are invested in real estate, get out.

You will take a huge loss from where things were a year ago, but things aren't going to be coming back.

Unless you are actually in a city where they are adding job, and so everyone will want to move there, there is nothing to soak up all the supply that is going to be dumped on the market. Even Phoenix AZ, which was having all kinds of growth, is now shrinking and the home prices are falling.

And all of this can be made worse by

- VAXXX deaths increasing

- Mortgage rates continuing to be pushed higher

- Banks failing, and thus mortgages harder to obtain

- People moving out to the country / homestead

- Rampant crime and riots in cities and suburbs

- Currency collapse

- Stock market crash

- Blackrock being sued for manipulating markets by holding inventory off the market.

I really do not know what to advice people to do with their homes.

If you have a good house with a good mortgage, it may be better to ride it into the scene of the crash. You will never be able to sell it, but at least you have a house to live in while all this stuff unwinds.

If you sell your house, where do you put the money? We are losing over 10% per year to inflation.

Putting it in the stock market only to watch that collapse to, would be very sad.

Putting it into crypto might be really good… in the long term, but not letting you live right now.

Putting the money in a bank… well, someday, FDIC might pay you what you lost.

If you are a boomer, move into a smaller place, or a retirement community as soon as possible. I expect the prices on retirement homes to spike for a bit, so you should buy it first, sell your house as fast as possible afterwards. But, i am quite certain, that if you wait, there won't be anyone to sell your house to.

Unless, of course, Blackrock decides to buy ALL the houses in America. They can just borrow all the money they want from the Fed. Of course, everyone will know that they are a scam forever after that.

We see some of the leading indicators in San Francisco, Austin, and other over valued cities. Lots of price cuts overall.

As another antidotal thing is that I have a couple friends in the LA area and they used to get a lot of Instacart orders. Now they can go almost all day with no orders.

I have heard of house sellers having to drop $200,000 off the price to get people to even come look.

The housing market is like an airplane that has stalled, its still sitting in the air, but not for long.

And yeah, people tightening belts. Like, all at once.

That's brutal.... $200K reduction. There seems to be a lot of strikes going on and ultimately it's hard saying when the whole thing will completely fall out. If people dig deep they start to see the holes. Obviously mortgage brokers and real estate agents are destitute at this point.