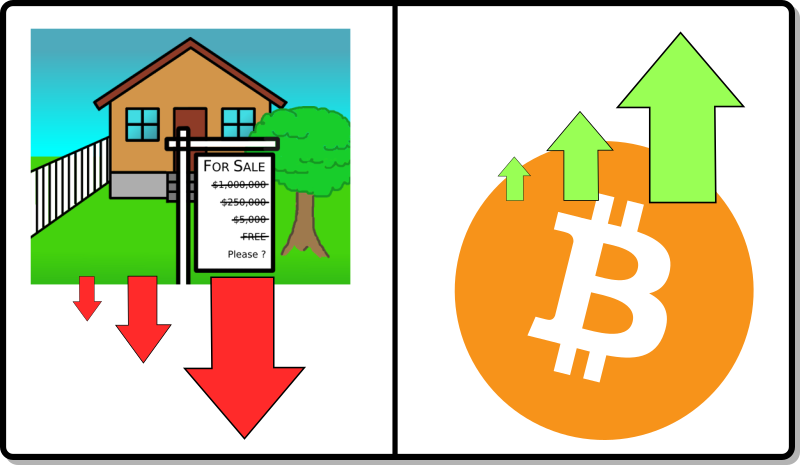

Housing is way up! Vs. The US dollar. But, Vs. bitcoin, it is down 90% over the past 10 years.

The US dollar is down 99% over the past 10 years, compared to bitcoin.

Houses are up, 2-300% over the past 10 years.

Still, that is down 90% compared to bitcoin.

Every year, the price of houses, in bitcoin, goes down.

So, obviously, you should wait forever to buy a house with your bitcoin…

What is actually going on with the markets?

We have a huge problem making judgements, to make plans about what will happen in the future, because none of this has happened before. Not even the fall of Rome teaches us much about this. Maybe the fall of Detroit can shed some light, but not much.

Housing prices are going up and up! Even today, the mean house price is still going up. But, this is completely a misconception.

Bitcoin looks like it in a bull run, and more and more of it is being taken off the table and locked up into ETFs, but the price is barely moving. Are we wrong about the massive, recent, buying of bitcoin? What is happening?

What is happening is we live in upside-down, clown world.

What we have is "money printer go brrrrr" to buy up assets for "friends" of the banks (it is not the banksters wearing a different hat, and glasses, no). And, they banksters are trying to keep the bubble going as long as possible. Yes, what they are doing is illegal and immoral. And they will hang for it.

At the same time, normal people are being squeezed. Those who had a comfortable life, are now finding all of their spare income is taken up by gas and food. Those who were struggling are now on the brink of collapse.

Bitcoin should be going way up in price, but there is few retail buyers (compared to the world's population) and housing prices should be going down (at least 50%, just based on interest rates) but they aren't moving much.

This is all manipulation, which has a lot of indicators saying it is all about to end.

Housing prices about to go DOWN

It is all about supply and demand. Until now, we have had not quite enough houses being built. This was done by limiting building permits, and making regulations that required bigger, more expensive houses to be built. And demand for houses in the cities where jobs are have been going up due to larger and larger demographics.

This year it is all changing. The population is on a decline, AND the largest demographic of home owners, the baby boomers, are about to "sell" their homes. 25% of homes are owned by the boomers. And they are going to be moving out. To care facilities or mortuary plots. What market does ok when ¼ of the existing supply is dumped on the market?

Further, we have banks holding onto houses, not letting them on the market. Trying to keep the prices high. If these banks have to mark-to-market these homes, their balance sheet crumbles. They go from being solvent, to being bankrupt in the flip of a pen.

There are about to be a huge amount of foreclosures. This is the plan by the top banksters. This is what happens when you go from easy money, to really hard money policy. (everyone can get a cheap loan to most people can't even get an expensive loan)

The biggest thing will be destruction of the job market. The Dems, with their allies the Reps, have pushed minimum wage way high. Which is going to lower the amount of jobs available at the low end. And big corporations are cutting staff for the big depression that is coming. This all adds up to good jobs being scarce. People move to where the jobs are. People leave when there are no more jobs. This means there will be a lot of houses for sale in blue-city suburbs.

And i haven't even talked about all the peeps dying from the clot shot, or the bank failures making mortgages impossible to get. Nor the riots and other crime that is coming. There will be such a glut of houses available, that it will become impossible to give them away.

House prices in the blue-state suburbs are going to below free.

However, which places in the country will people migrate to? My feeling is homesteads. And those will be going up in value.

Bitcoin goes up (or is that the dollar crashing?)

Bitcoin is now in a bull run? Maybe, but it is early in the halving cycle, but there are ETFs hungrily gobbling up bitcoin, so the price should be spiking, but it is not.

Only one thing to do. Zoom out, and take a deep breath.

Lots of manipulation is happening. But, on a larger scale, it looks like adoption is finally getting started. And on the bigger picture, bitcoin is WAY up.

Bitcoin will go to 1 million just because of the dollar crashing.

It really doesn't help that the banksters are planning to kill the dollar too. So, bitcoin has done, and will be doing far better than all other asset classes. Bitcoin is going to keep going up until it becomes the thing that everything is valued it.

So, when should you get out of bitcoin and into real estate?

The answer is… never?

This question is based on the ebb and flow of markets of yore. 2006 was a time to get out of real estate. 2009 was the time to start looking for real good deals on real estate. And people expect a next cycle.

However, this time it is different. Most suburbs, especially in blue cities, will be abandoned. So, the question becomes, when should you invest in a future ghost town? And the answer is, only if you want to take on the endeavor or reserecting it.

Bitcoin will continue to go up. Suburban housing will continue to go down. So there is no time in the next half-century when you will want to buy a suburban home thinking that it will be a good investment.

That said, there are other things at play when we are speaking of housing.

- You need somewhere to live.

- You may have so much crypto, that acquiring the home may be seen as petty cash.

- Homesteads, especially good ones will probably be going up in value.

Instead of looking at housing as an investment, we need to change our focus to what is the best use of our money at the current time. Where do you need to live, and what is the best value at that time. It is very difficult to include "planning for the future" in this equation. The idea of building equity will become meaningless the further out in time we go. However, improvements to the property, such as adding chicken coops, gardens and greenhouses may be considered priceless, which you are loathe to give up when you need to leave.

My best suggestions are to find property, where you will feel good about homesteading and buy that. Try not to spend more than half your crypto bag on it. As long as you still have some bitcoin, it will go up faster than you can spend it at some point. But this needs to be balanced with getting your farm producing. At some point good food will become harder to find than hen's teeth.

Excellent analysis of our F-ing clown world situation. I'm looking for that small homestead but everything you say makes it harder a harder to get. Can't wait to get settled feeding my hens with teeth proof gloves //

I agree, I just want a home, not a “investment”. Even in other measures outside bitcoin housing is due to pop. Maybe not in fiat but many other value measures. Great points friend 👍

This is a good way to be thinking of housing.

The boomers were sold on the "Your home is an asset", and very few ever questioned that. Especially when house price go up.

Home is where the heart is, and people will not be accepting tiny, nuclear family, stick built houses any more. Selling, moving up, "equity" will not be part of thoughts about housing in the future.