Stock Markets Ready Pop and Drop and then Pop Again - Trading Journal (1.25.21)

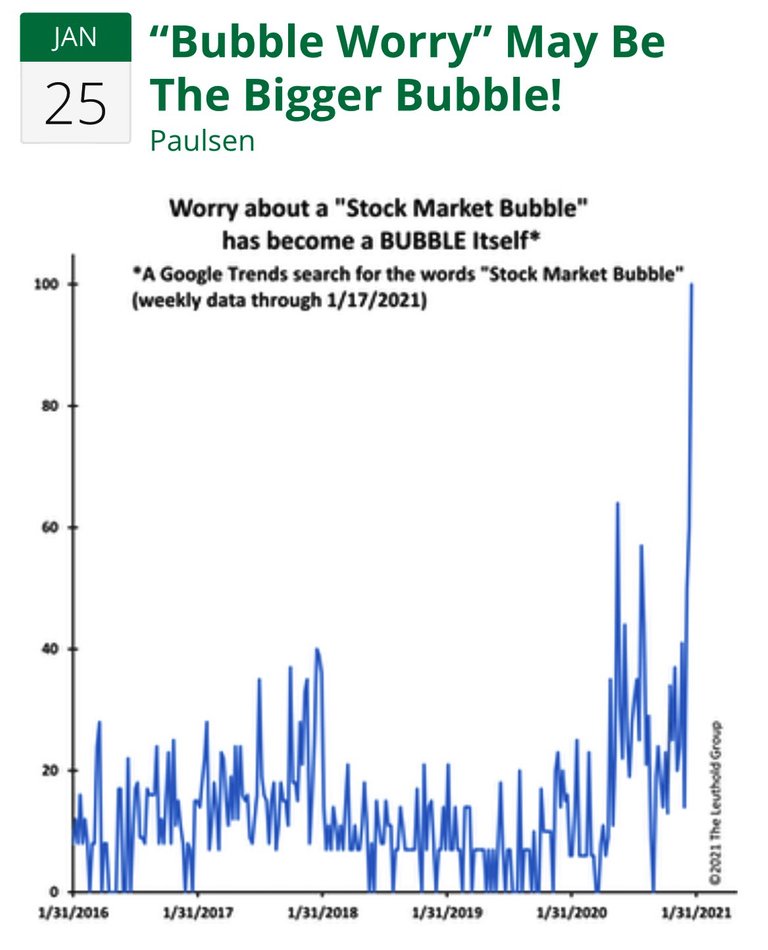

S&P today open higher but was quickly sold off around 10am only to recover and close near its open. This type of quick drop and recovery is happening more often in the past month than previously year and it may likely be a sign of a top.

The trouble with these swift drops is that they all tend to have been bought back up and prices continue to move in an uptrend. In some chance it may likely be due to too many bearish bets on the index. Shorts require to cover to close their positions essentially is providing the market support for buying. So when certain price levels are hit to the downside they are immediately bought and a continuation of buying occurs as shorts need to cover to avoid massive loses if the price continues to move up.

Short Squeeze

Blackberry

Express, Inc - Retail Clothing (EXPR)

GOGO

PLTR

SPCE

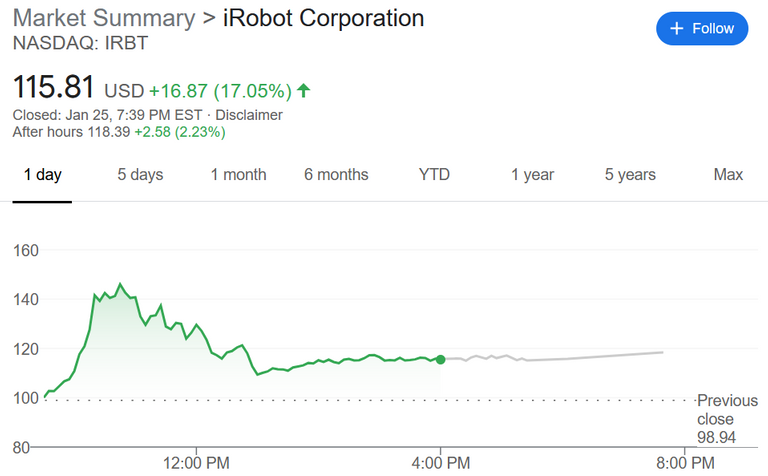

IRBT

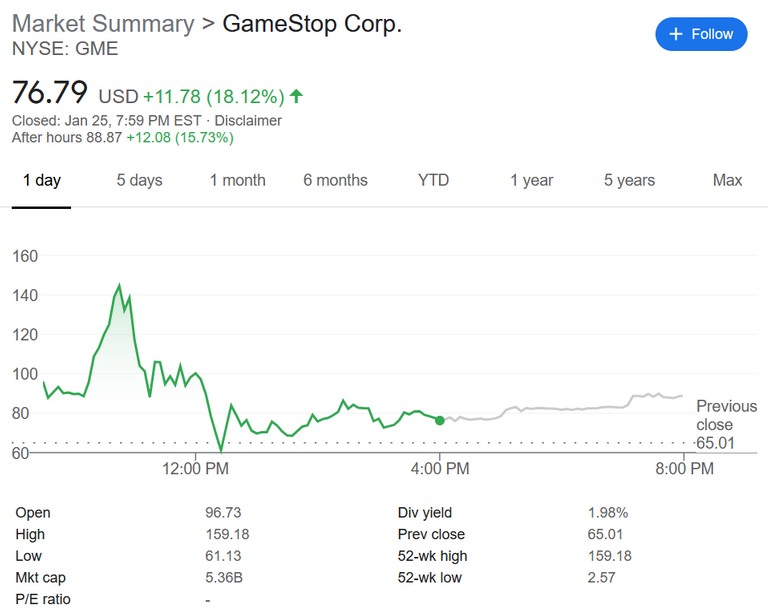

All these stocks listed and many more are being bid up due to call option buying spree from most likely retail. Not to say they are the only ones forcing stocks to be bid up but the acceleration and price targets have been pretty impressive if one is bullish. Those call options are forcing the other side of the trade to hedge against delta changes therefore they have to outright buy shares of the stock. With the shares getting bid the prices rises. Then there is the over crowded shorts in these tickers that are trapped and in order to avoid significant losses they tend to buy back the stock they shorted. This adds the fuel of buying on these tickers and making the speed of price rises accelerate to the point where even GME today literally double during intraday trading.

The point of the matter here is when a lot of trades are leaning on one direction the likelihood that it will revert and revert hard. If in fact there are a lot of traders shorting indexes the mean revert would be to the upside. While individual stocks as listed in this post have massive amount of shares shorted and when prices rises too quickly the shorts are forced to cover.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HIveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

Congratulations @mawit07! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Yay! 🤗

Your post has been boosted with Ecency Points.

Continue earning Points just by using https://ecency.com, every action is rewarded (being online, posting, commenting, reblog, vote and more).

Support Ecency, check our proposal:

Ecency: https://ecency.com/proposals/141

Hivesigner: Vote for Proposal